-TDS Returns-

Please watch video : https://youtu.be/3gtsb13vnvI?si=Bs0mLTUvBAHPzKzO

Guide for Uploading TDS Returns on the Income Tax Portal

Sometimes navigating and uploading a TDS return on the TRACES portal can be difficult for some taxpayers. Complying with the data procedure too has been found tedious by many. Therefore, to ease the process the income tax department has provided for uploading the return on their own website, which we cover in detail in this article.

Prerequisites for uploading TDS returns

Before you start uploading the return, you must ensure the following.

- You must hold a valid TAN and it should be registered for e-filing

- Your TDS statements should be prepared using Return Preparation Utility (RPU) and validated using File Validation Utility (FVU)

- You can prepare your returns in an easy manner using ClearTDS

- You should have a valid DSC registered for e-filing if you wish to upload using DSC

- The principal contact’s bank account or Demat account details should be provided or the principal contact’s PAN should be linked with Aadhar if you wish to upload using EVC

How to upload TDS statements on the income tax portal

Here is a step-by-step guide on uploading TDS statements on the income tax website:

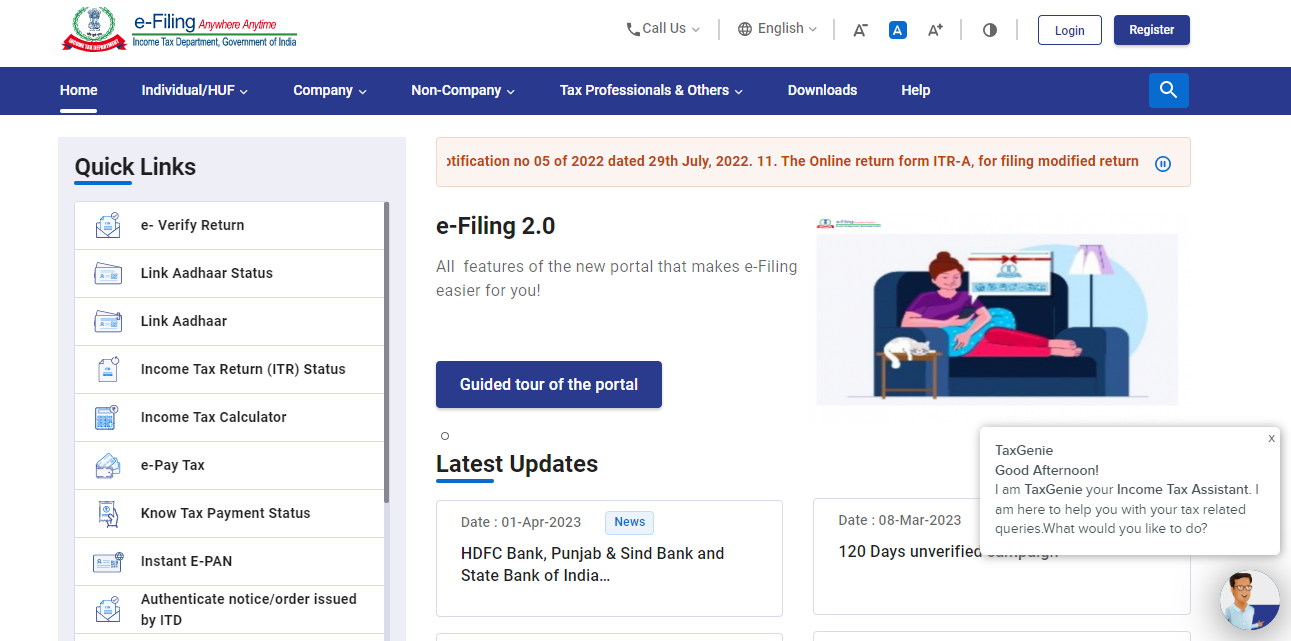

Step 1: Go to http://incometaxindiaefiling.gov.in/

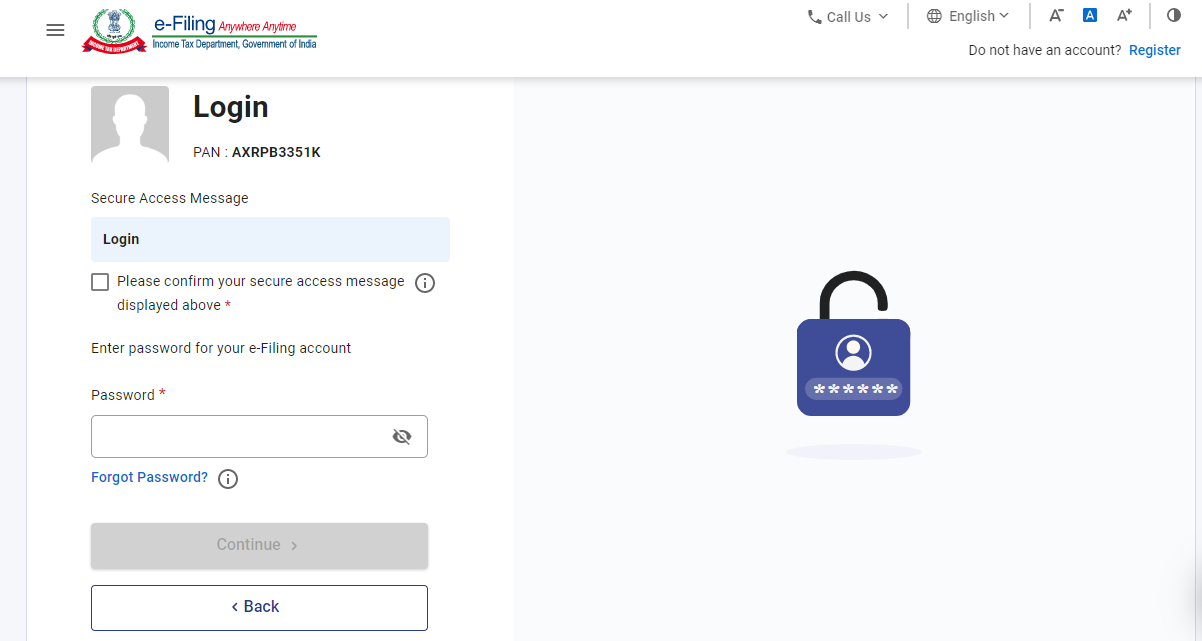

Step 2: Log in using your TAN details.

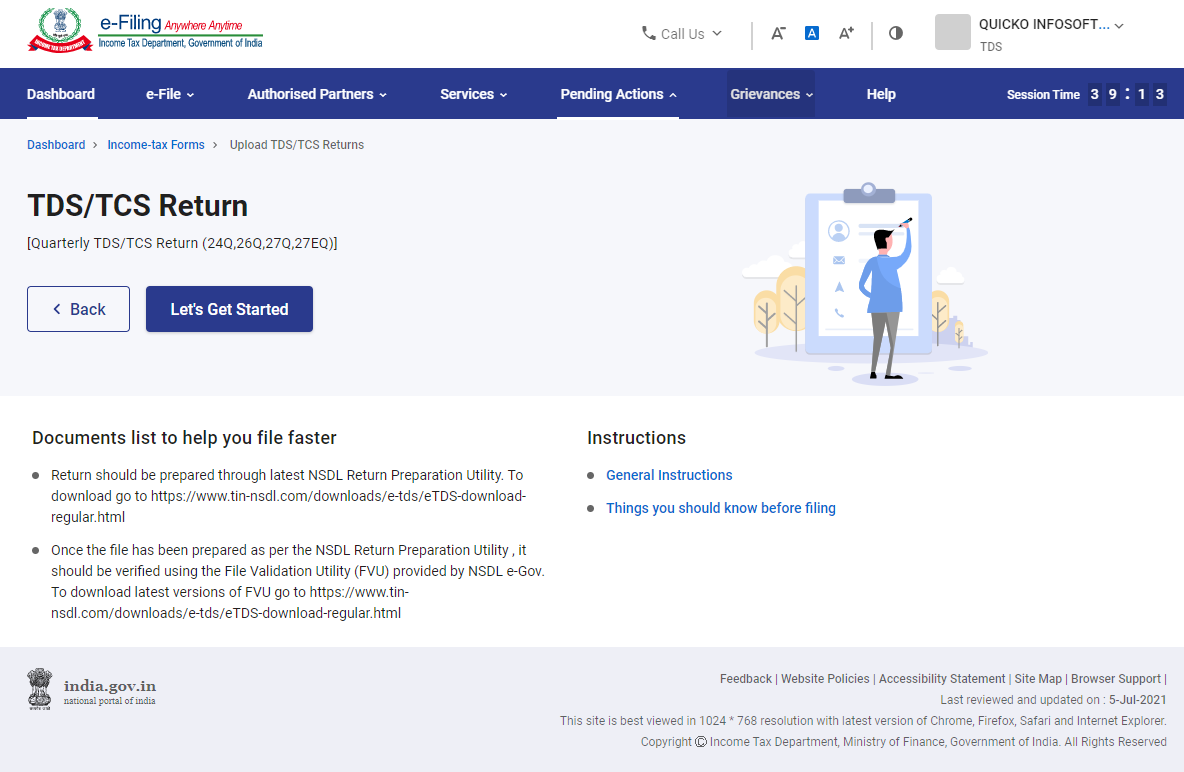

Step 3: Click on ‘e-File’, then ‘Income Tax Forms’ and then ‘File Income Tax Forms’ from the dashboard.

Step 4: Select the form you have to file.

Step 5: Proceed to ‘Upload TDS Form’: Click on the ‘Let’s Get Started’ option.

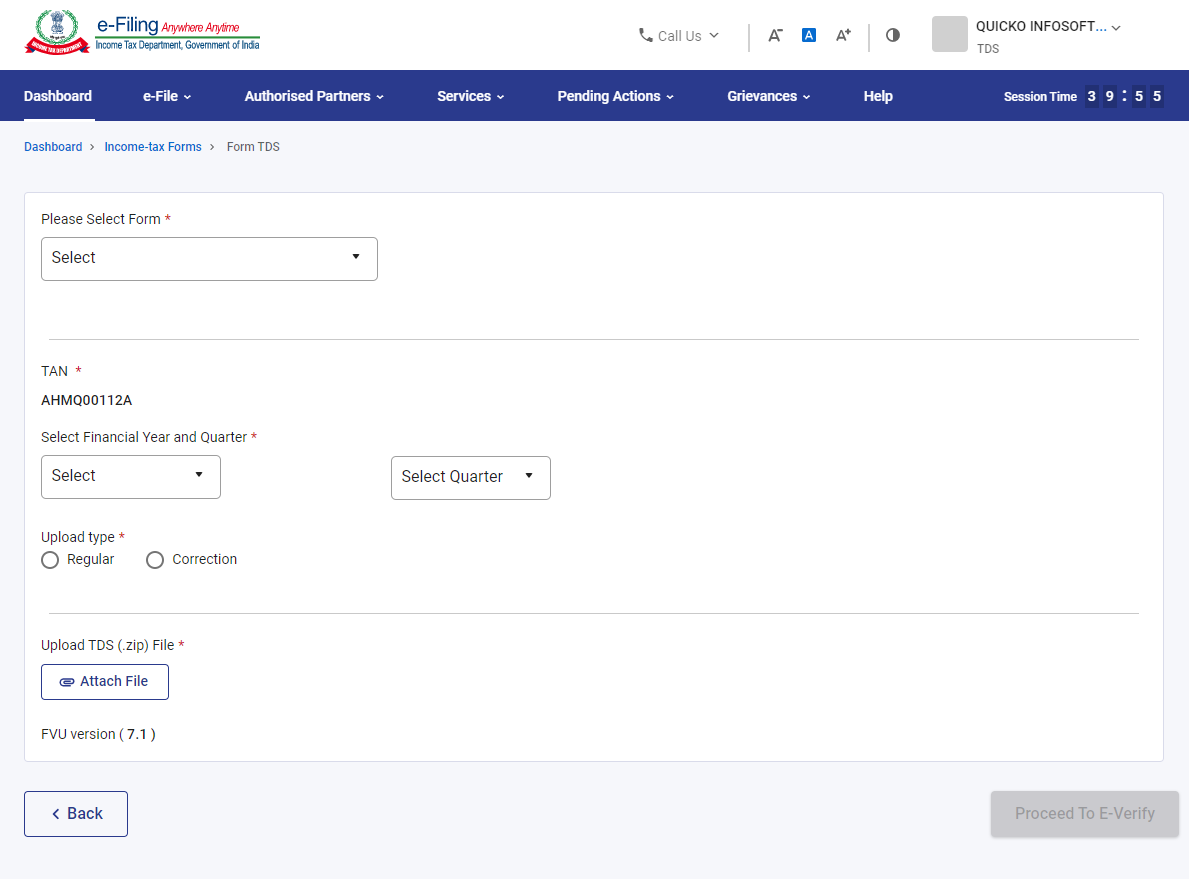

Step 6: Enter the following details and then click on ‘Proceed to e-Verify’:

Step 7: Validate the return using the OTP sent to the registered mobile number to complete the process.

Following the completion of the process, you will receive a success message. If you haven't already generated your DSC, you can use the Electronic Verification Code to validate the TDS statements (EVC).

Frequently Asked Questions

Who must submit e-TDS/TCS statements?

According to the Income Tax Act of 1961, all corporate and government deductors/collectors are expected to file their TDS/TCS statements electronically, i.e. e-TDS/TCS returns.

How can I tell whether my TDS return has been processed?

It ideally takes one week to process your return post submission. You can log in to your TRACES account and check the status of the TDS return. You can even file a correction return in case of any mistakes.

What happens once I submit my TDS return?

Once you've filed your TDS return and if it's accepted, you will see ‘Accepted at e-filing'.